The Home Ready Map: A Blueprint for Successful Homeownership

Related Articles: The Home Ready Map: A Blueprint for Successful Homeownership

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Home Ready Map: A Blueprint for Successful Homeownership. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Home Ready Map: A Blueprint for Successful Homeownership

Navigating the complex world of homeownership can be daunting, even for seasoned individuals. The process involves numerous steps, each with its own intricacies and potential pitfalls. This is where a comprehensive homeownership preparation plan becomes indispensable.

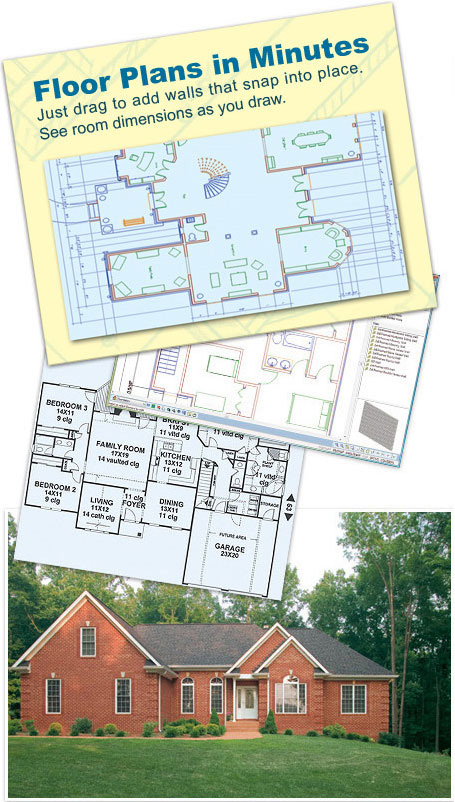

Understanding the Home Ready Map

The concept of a "Home Ready Map" encapsulates a strategic, step-by-step approach to preparing for homeownership. It’s not merely a checklist but a dynamic roadmap that guides individuals through the entire process, from financial planning to property selection and beyond.

Key Components of a Home Ready Map

A well-structured Home Ready Map encompasses the following essential elements:

1. Financial Foundation:

- Assessing Financial Health: This involves analyzing income, expenses, debt, and credit score to understand the current financial landscape.

- Budgeting and Savings: Establishing a realistic budget and creating a dedicated savings plan for a down payment, closing costs, and potential future expenses.

- Credit Improvement: Taking steps to improve credit scores by paying bills on time, managing debt responsibly, and avoiding unnecessary credit applications.

- Mortgage Pre-Approval: Obtaining a pre-approval letter from a lender demonstrates financial readiness and helps determine the affordability range for home purchase.

2. Property Research and Selection:

- Defining Needs and Wants: Clearly identifying essential features and desired amenities in a home, considering factors like location, size, and style.

- Market Research: Thoroughly understanding the real estate market, including price trends, inventory levels, and local regulations.

- Property Viewing and Assessment: Visiting potential properties, evaluating their condition, and seeking professional inspections for structural integrity and safety.

- Negotiation and Offer: Developing a strategic negotiation approach based on market data and personal preferences.

3. Closing and Beyond:

- Closing Costs: Understanding and budgeting for various closing costs, including appraisal fees, title insurance, and transfer taxes.

- Home Insurance and Maintenance: Securing adequate home insurance coverage and establishing a routine maintenance plan for long-term property care.

- Post-Purchase Financial Management: Developing a sustainable budgeting strategy that accommodates mortgage payments, property taxes, utilities, and other expenses.

Benefits of a Home Ready Map

Implementing a Home Ready Map offers numerous advantages:

- Increased Financial Security: A structured financial plan ensures responsible debt management, strengthens creditworthiness, and builds a solid financial foundation.

- Reduced Stress and Anxiety: Having a clear roadmap eliminates uncertainty and provides a sense of control during the complex homebuying process.

- Enhanced Negotiation Power: A pre-approved mortgage and a thorough understanding of the market position buyers for stronger negotiations.

- Informed Decision-Making: The process encourages research and analysis, enabling individuals to make informed decisions based on their needs and financial capabilities.

- Improved Homeownership Experience: A well-defined plan ensures a smoother transition into homeownership, minimizing surprises and potential challenges.

FAQs about the Home Ready Map

1. How long does it take to create a Home Ready Map?

The time required to create a comprehensive Home Ready Map varies depending on individual circumstances and the complexity of the plan. It can take several weeks or even months to assess finances, research properties, and finalize negotiations.

2. Is it necessary to hire a professional for assistance?

While it’s possible to create a basic Home Ready Map independently, seeking professional guidance from a financial advisor, real estate agent, or mortgage broker can significantly enhance the process.

3. What are the potential challenges in implementing a Home Ready Map?

Challenges can arise from unforeseen financial setbacks, fluctuations in the real estate market, or unforeseen issues during property inspections. Flexibility and adaptability are crucial for navigating such obstacles.

4. How can I track my progress and stay on track with the Home Ready Map?

Use a spreadsheet, a dedicated notebook, or a digital planner to track milestones, deadlines, and financial progress. Regular review and adjustments are essential to ensure alignment with the plan.

5. What happens if my financial situation changes after creating the Home Ready Map?

Changes in financial circumstances are inevitable. Regularly reassess the plan, adjust budget projections, and consult with financial professionals to ensure the plan remains viable.

Tips for Creating and Implementing a Home Ready Map

- Set Realistic Goals: Avoid setting unrealistic expectations that can lead to frustration and disappointment.

- Seek Professional Advice: Consult with financial advisors, real estate agents, and mortgage brokers for specialized guidance.

- Be Prepared for Unexpected Expenses: Allocate a contingency fund to cover unforeseen costs that may arise during the process.

- Stay Informed: Continuously research the real estate market, local regulations, and financial trends.

- Review and Adjust Regularly: Periodically review the plan and make necessary adjustments based on changing circumstances.

Conclusion

A Home Ready Map serves as a powerful tool for navigating the complexities of homeownership. By providing a structured framework for financial planning, property research, and closing preparations, it empowers individuals to make informed decisions, minimize risks, and achieve their dream of homeownership with confidence. Remember, a well-defined plan fosters a smoother and more rewarding journey toward homeownership.

![Your Journey to Homeownership [INFOGRAPHIC] - Christine Pervan Mid](http://mtg-lady.com/wp-content/uploads/2021/11/20211119-MEM.png)

Closure

Thus, we hope this article has provided valuable insights into The Home Ready Map: A Blueprint for Successful Homeownership. We appreciate your attention to our article. See you in our next article!